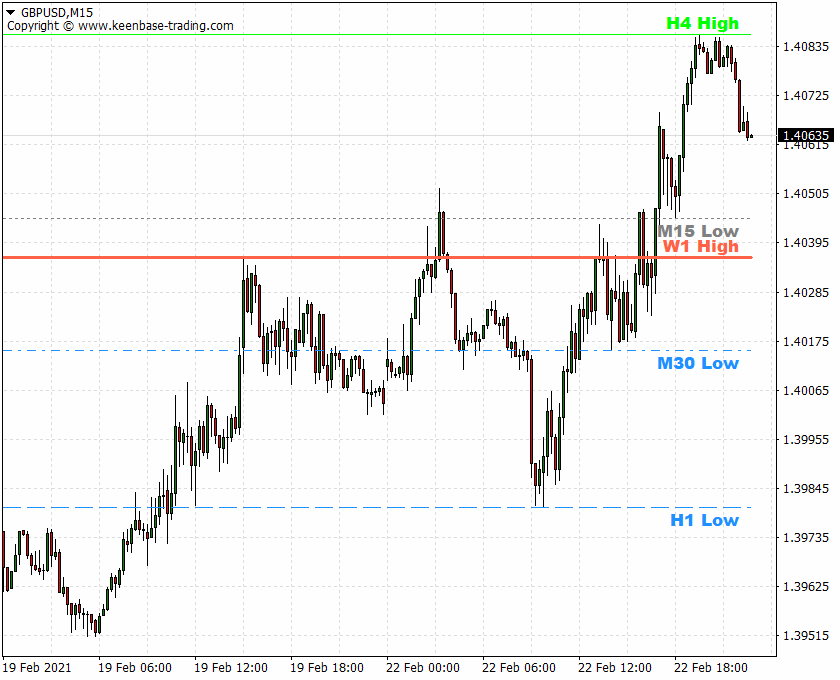

The upper ADR level is particularly advantageous for taking profits. To maximize profits, forex traders can buy when the price is near the lower ADR level and set the stop loss below the last swing low. ADR provides a reliable estimate of the market range, allowing traders to better understand the price extremes. However, by adjusting your stop loss to below the ADR line, you can better protect it.įorex traders can leverage the Average Daily Range (ADR) as a tool for implementing two key trading strategies – breakout and reversal. For example, based on the intraday chart pattern, you may have set your stop loss above the lower ADR line for a BUY trade. Since the two lines are drawn by calculating the average, they can be helpful in adjusting your stop loss or take profit levels. If the price breaks either the upper or lower line, it indicates that the market volatility is higher than usual, and it may be advisable to stay out of the forex market during such periods. These lines serve as indicators that the price will likely remain within them.

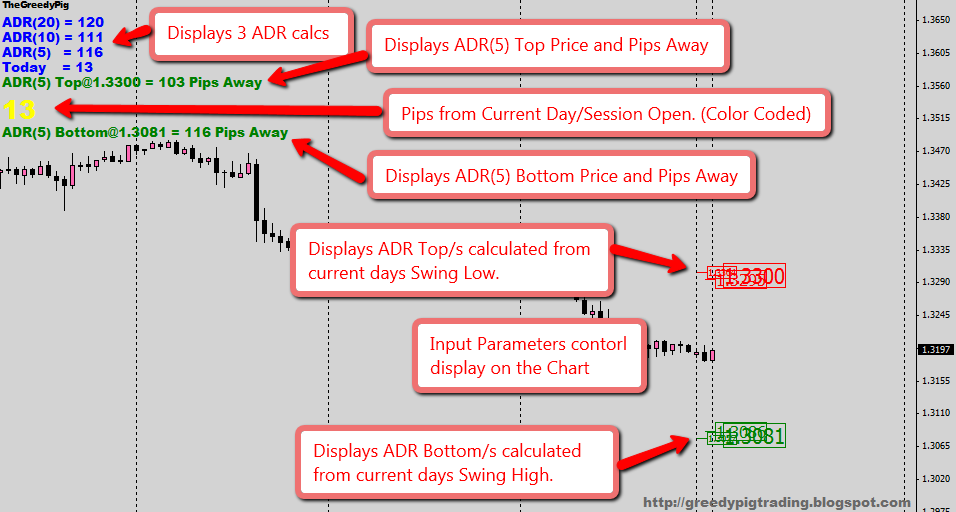

Once the average has been calculated, the ADR plots two lines above and below the current price. However, you can modify this value to fit your strategy, such as setting it to 10 or 15 or any other desired value. The current ADR is determined using the information from the last five daily candlesticks. That forex indicator is free to download and easy to install.īy default, the ADR indicator calculates the average daily range based on the previous five days’ data. Meanwhile, experienced traders can incorporate the indicator into their existing trading systems.

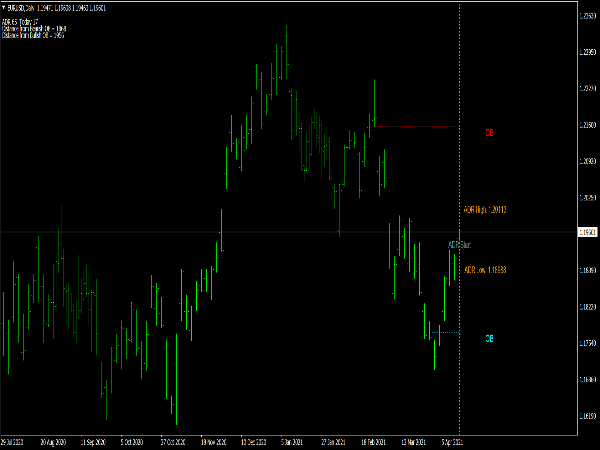

ADR values serve as the foundation for many forex technical indicators and are incorporated into various trading strategies.īeginners can leverage the ADR-levels as support and resistance and keep an eye on price action in these areas. Notably, changes in trade volume and momentum near the upper or lower ADR-level can indicate the beginning of a trend or reversal. Once you’re done, your trading chart should look similar to the example below.Īs you can see, that forex indicator plots two lines indicating the high and low daily range. The download link of the ADR MT4 indicator is placed at the bottom of this post. Sounds good? Let’s take a closer look at it and bring some practical trading examples. That way, it helps traders to forecast the take profit and stop-loss levels as well as the support and resistance levels. The ADR Indicator MT4 is a forex technical analysis gauge that measures the average daily range of the market for the current day.

0 kommentar(er)

0 kommentar(er)